Tips For Improving Your Credit Score

Improving your credit score is essential in today’s world, as it can affect your ability to secure loans, credit cards, and even housing. A good credit score also helps you save money on interest rates and insurance premiums. However, if you’re struggling with a low credit score, it can seem like an insurmountable obstacle.

Fortunately, there are steps you can take to improve your credit score and take control of your financial future. In this article, we’ll explore some simple yet effective strategies for boosting your credit score.

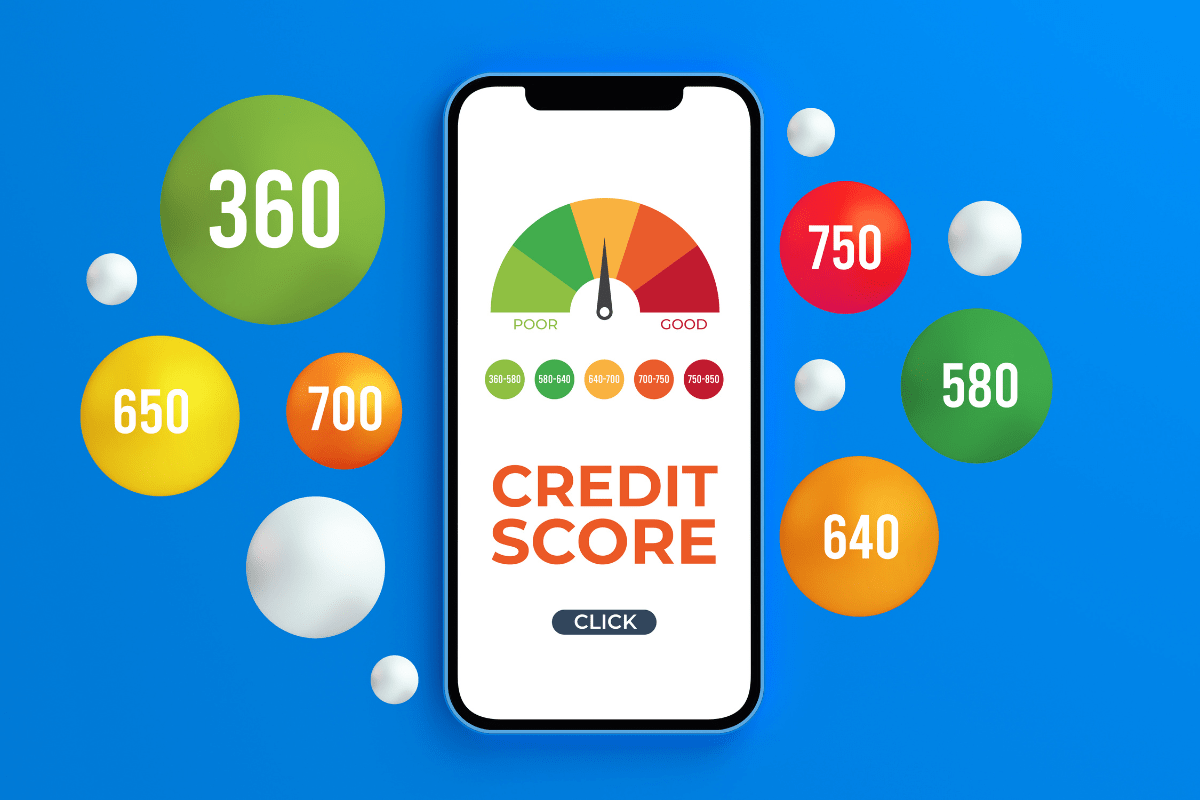

How Is Your Credit Score Calculated?

Credit scores are calculated using the information found in your credit reports. It’s a common myth that you have only one credit score. In reality, credit scores can vary depending on the scoring model used to calculate them.

Your credit score could also vary based on which nationwide consumer reporting agency—Equifax, TransUnion or Experian—provides the data. This is because not all lenders and creditors report to all three agencies. Some report to only one or two, or even none at all. Thanks to all these variables, you have multiple credit reports and credit scores.

Pay Your Bills On Time

Paying your bills on time is crucial for improving your credit score. Late payments can lower your score and significantly impact your creditworthiness. Consistently paying your bills by the due date demonstrates financial responsibility and reliability to lenders.

Additionally, making on-time payments can help you avoid late fees and interest charges, saving you money in the long run. By prioritizing timely bill payments, you can take a positive step towards improving your credit score and overall financial health.

Keep Your Credit Card Balance Low

Keeping your credit card balance low is an important factor in improving your credit score. Your credit utilization ratio, which is the amount of credit you use compared to your credit limit, is a crucial element in determining your credit score.

When you keep your credit card balances low, you are effectively reducing your credit utilization ratio, which can positively impact your credit score. It is recommended to keep your credit utilization ratio below 30% to maintain a good credit score.

By managing your credit card balances wisely, you can improve your credit score and increase your chances of being approved for credit in the future.

Don’t Close Old Credit Accounts

Keeping old credit accounts open can actually improve your credit score. This is because the length of your credit history is a factor in determining your credit score. By keeping older accounts open, you are able to demonstrate a longer credit history, which can help improve your score.

Additionally, having a mix of different types of credit accounts, such as credit cards and loans, can also positively impact your credit score. So, instead of closing old credit accounts, consider keeping them open and using them responsibly to help improve your credit score over time.

Check Your Credit Report Regularly

Errors on your credit report can hurt your score. Check your report at least once a year to make sure everything is accurate. You can get a free copy of your report from each of the three major credit bureaus once a year at AnnualCreditReport.com.

Be Careful When Applying for New Credit

Every time you apply for credit, it can have a small negative impact on your score.

You should be careful about applying for new credit because multiple credit inquiries can lower your credit score and make it harder for you to get approved for credit in the future. Additionally, having too much credit can lead to overspending and debt. It’s important to only apply for credit when you really need it and to make sure you can manage it responsibly.

How Long Does it Take to See Changes in Credit Score?

Improving a damaged credit score can take varying amounts of time, depending on individual circumstances. Overcoming certain negative factors, such as one late payment or a few hard inquiries, may be quicker than recovering from a foreclosure or account collection.

Negative information typically remains on credit reports for up to seven years, except for Chapter 7 bankruptcies, which can stay for 10 years. It’s important to approach credit score improvement with patience and effort, as there’s no quick-fix solution.

Improving your credit score takes time and effort but is worth it in the long run. By following these tips, you can improve your score and enjoy the benefits of better credit.